In today’s fast-paced digital world, Finance Phones have become a game-changer in the way people manage their money. With the rapid growth of financial technology (fintech), smartphones are no longer just communication devices; they are powerful tools for banking, investing, budgeting, and securing transactions. Finance Phones integrate advanced financial applications, artificial intelligence, and security features, making them essential for individuals and businesses alike. Whether you’re handling daily expenses, trading stocks, or running a business, Finance Phones provide convenience, efficiency, and security like never before.

The Evolution of Finance Phones in Financial Management

The rise of Finance Phones has completely transformed financial management. Traditional banking and investment processes that once required physical visits to financial institutions can now be done instantly through smartphones. Mobile banking applications, digital wallets, and AI-driven financial planning tools have made it easier for users to take control of their finances.

With Finance Phones, users can check their account balances, transfer funds, apply for loans, and even automate their savings. Many fintech companies have developed applications that provide real-time stock market updates, cryptocurrency tracking, and AI-driven financial advice. These advancements have allowed users to make informed financial decisions, increasing financial literacy and independence.

Key Features of Finance Phones That Enhance Financial Management

1. Mobile Banking and Digital Wallets

One of the most significant features of Finance Phones is mobile banking. Users can access their bank accounts, send money, pay bills, and manage their financial transactions with just a few taps. Digital wallets like Apple Pay, Google Pay, and Samsung Pay allow for seamless transactions, reducing the need for cash and credit cards.

2. AI-Powered Financial Assistance

Artificial intelligence plays a major role in the functionality of Finance Phones. AI-driven applications can analyze spending habits, categorize expenses, and provide personalized budgeting advice. Virtual financial assistants help users optimize their savings, investment strategies, and overall financial health.

3. Secure Transactions with Blockchain Technology

Security is a major concern in financial transactions. Finance Phones use blockchain technology to ensure that payments and financial data remain secure and tamper-proof. Features like biometric authentication (fingerprint and facial recognition) add an extra layer of protection against fraud and identity theft.

4. Stock Market and Investment Management

For investors, Finance Phones provide instant access to trading platforms and financial analysis tools. Real-time stock market data, AI-generated predictions, and cryptocurrency exchange platforms allow users to make smart investment choices. Whether you’re a beginner or an experienced trader, Finance Phones make investing more accessible.

5. Contactless Payments and NFC Technology

The rise of Near Field Communication (NFC) technology has made contactless payments faster and more efficient. With Finance Phones, users can make secure payments by simply tapping their phones on payment terminals. This technology is widely adopted by businesses, making transactions more convenient for consumers.

6. Automated Bill Payments and Subscription Management

Managing bills and subscriptions has never been easier. Finance Phones allow users to automate recurring payments, ensuring that bills are paid on time. Many applications also help users track and manage their subscriptions, preventing unnecessary charges.

7. Personal Finance Tracking and Budgeting

Budgeting apps available on Finance Phones help users track their expenses and plan their financial goals. Applications like Mint, YNAB (You Need a Budget), and PocketGuard provide detailed insights into spending patterns, helping users manage their finances more effectively.

The Role of Finance Phones in Business Operations

Businesses of all sizes are leveraging Finance Phones to streamline financial operations. From accepting payments to managing payroll, these devices provide businesses with efficient and cost-effective financial solutions.

1. Mobile Point-of-Sale (POS) Systems

Many businesses, especially small retailers and entrepreneurs, now use Finance Phones as mobile POS systems. Payment solutions like Square, PayPal Here, and Stripe allow businesses to accept payments from customers without requiring expensive hardware.

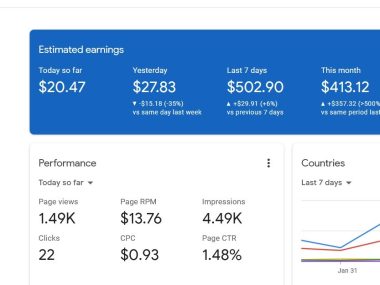

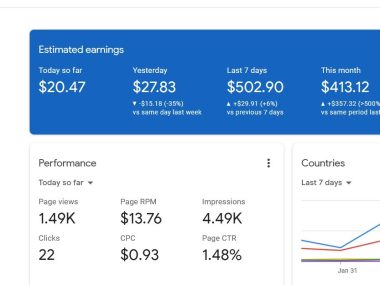

2. Real-Time Financial Analysis

Business owners can use Finance Phones to track cash flow, monitor expenses, and generate financial reports in real time. Cloud-based accounting applications provide insights into a company’s financial health, enabling better decision-making.

3. Payroll and Tax Management

Managing payroll and taxes can be complex, but Finance Phones simplify the process. Business owners can use payroll management applications to process salaries, calculate tax deductions, and ensure compliance with financial regulations.

4. Invoice Generation and Payment Tracking

Freelancers and business owners can generate digital invoices, send payment reminders, and track payments through Finance Phones. This reduces delays in receiving payments and improves cash flow management.

The Future of Finance Phones: Upcoming Innovations

As technology continues to advance, the capabilities of Finance Phones will expand further. AI-driven financial advisors, decentralized banking, and biometric security enhancements are set to redefine the financial technology landscape.

1. AI-Powered Virtual Financial Advisors

Future Finance Phones will integrate more advanced AI-driven financial assistants that provide real-time advice based on user spending patterns. These assistants will offer investment recommendations, suggest savings strategies, and optimize budget planning.

2. Integration of Decentralized Finance (DeFi)

Decentralized finance (DeFi) is transforming the financial industry by eliminating intermediaries in banking transactions. Finance Phones will enable users to access DeFi platforms, borrow and lend money, and earn interest on their crypto holdings.

3. Advanced Biometric Security Features

Security measures in Finance Phones will continue to improve. Retina scanning, voice recognition, and heartbeat authentication are some of the upcoming biometric security features that will enhance financial security.

4. Cryptocurrency Banking and Blockchain Integration

With the growing adoption of cryptocurrencies, Finance Phones will integrate more cryptocurrency wallets, allowing users to store, trade, and transfer digital assets securely. Blockchain-based banking will offer enhanced transparency and security.

5. Augmented Reality (AR) for Financial Planning

Future Finance Phones may incorporate augmented reality (AR) to visualize financial data in an interactive manner. Users will be able to see their expenses, investments, and savings goals in 3D, making financial planning more engaging and effective.

Challenges and Considerations in Using Finance Phones

Despite their numerous advantages, Finance Phones come with certain challenges that users and businesses need to be aware of:

•Cybersecurity Risks: As financial transactions become more digital, the risk of cyberattacks increases. Users must ensure that their Finance Phones have the latest security updates.

•Digital Divide: Not everyone has access to high-end smartphones or stable internet connections, creating a gap in financial inclusion.

•Regulatory Challenges: Governments and financial institutions need to regulate the use of Finance Phones to prevent fraud, data breaches, and illegal financial activities.

Conclusion

Why Finance Phones Are the Future of Financial Management

Finance Phones have revolutionized the way people and businesses manage their finances. With mobile banking, AI-driven financial planning, blockchain security, and contactless payments, these devices provide an all-in-one financial management solution. As financial technology continues to evolve, Finance Phones will become even more powerful, offering smarter, faster, and safer financial transactions.

Adopting Finance Phones ensures better financial management, seamless transactions, and enhanced security. Whether you’re an individual looking to improve your financial health or a business seeking efficient payment solutions, Finance Phones are the future of financial technology. By embracing this innovation, users can enjoy greater convenience, financial independence, and a smarter way to manage their money.